Forecasting the Housing Market in 2025: A Comprehensive Analysis

Forecasting the Housing Market in 2025: A Comprehensive Analysis

Introduction

With great pleasure, we will explore the intriguing topic related to Forecasting the Housing Market in 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

![28+ Housing Market Predictions 2021-2025 [Crash Coming?]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/11-More-Housing-Market-Predictions-For-2022-2023-2024-2025-Infographic.png)

Forecasting the Housing Market in 2025: A Comprehensive Analysis

Predicting the future of the housing market is a complex task, subject to a multitude of economic, social, and political factors. However, by analyzing current trends and examining potential future influences, it is possible to develop a reasoned outlook for the housing market in 2025. This analysis aims to provide a comprehensive understanding of the factors that will shape the housing market in the coming years, focusing on potential price fluctuations, market dynamics, and implications for buyers and sellers.

Factors Influencing Housing Market Dynamics in 2025:

Several key factors will contribute to the evolution of the housing market in the coming years. These include:

1. Economic Growth and Interest Rates:

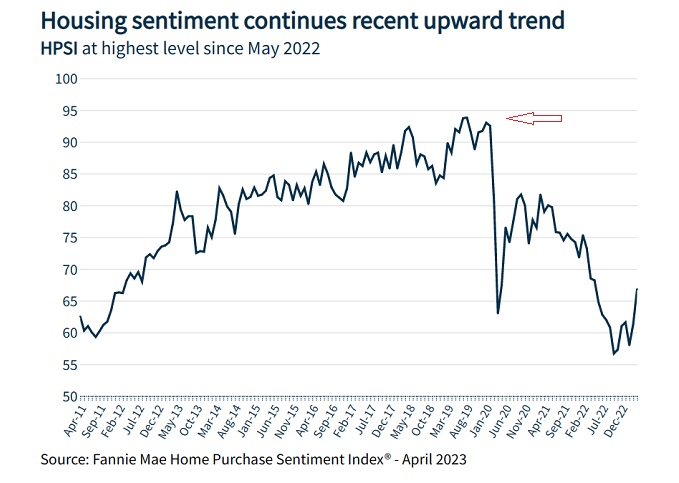

Economic growth is a significant driver of housing demand. A robust economy generally leads to increased employment, higher wages, and greater consumer confidence, all of which contribute to a more active housing market. Conversely, economic downturns can lead to job losses, reduced purchasing power, and a decrease in demand for housing.

Interest rates play a crucial role in housing affordability. Lower interest rates make mortgages more affordable, stimulating demand. Conversely, higher interest rates increase the cost of borrowing, potentially dampening demand. The Federal Reserve’s monetary policy decisions, aimed at controlling inflation, will significantly influence interest rate movements and, consequently, housing market activity.

2. Demographics and Population Growth:

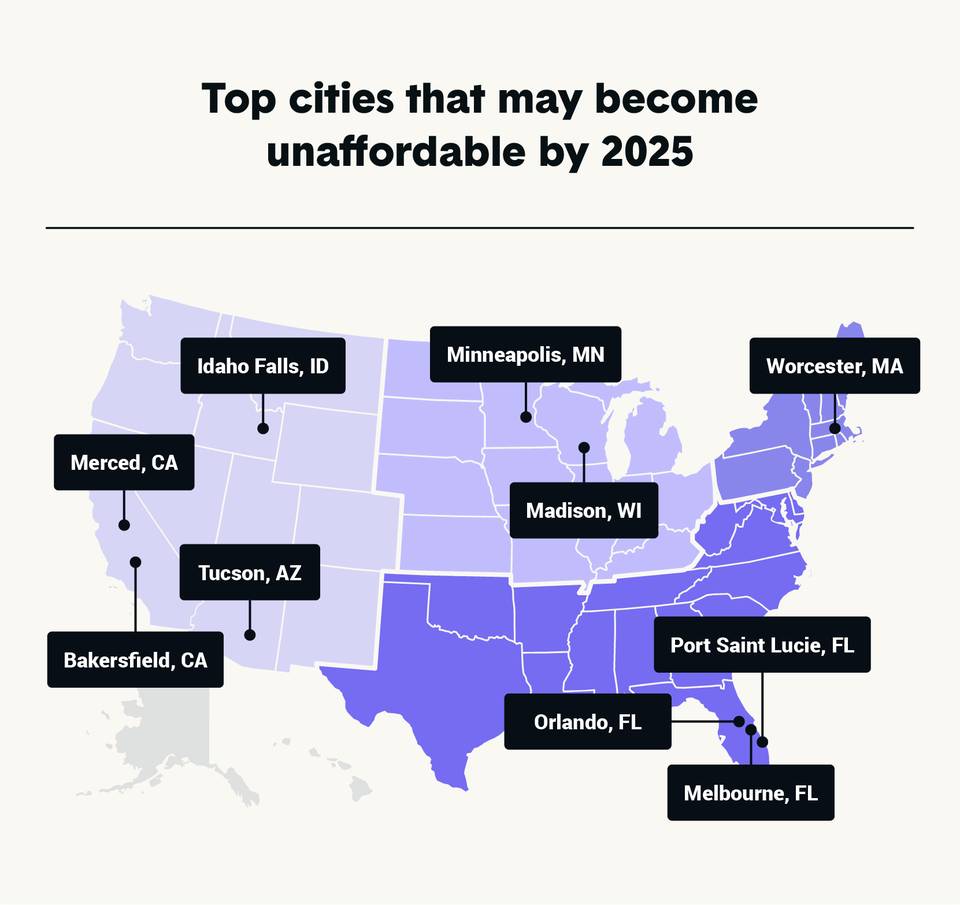

Demographic trends, particularly population growth and age distribution, have a significant impact on housing demand. Growing populations, particularly in urban areas, can lead to increased demand for housing, driving up prices. Aging populations, with their changing housing needs, can also influence market dynamics. The migration patterns of individuals and families, driven by factors such as employment opportunities and lifestyle preferences, will also impact local housing markets.

3. Government Policies and Regulations:

Government policies related to housing, including tax incentives, zoning regulations, and mortgage lending rules, can significantly influence housing market dynamics. Policies aimed at promoting homeownership, such as tax breaks for first-time buyers, can stimulate demand. Conversely, regulations restricting development or increasing the cost of construction can limit housing supply, potentially driving up prices.

4. Technological Advancements:

Technological advancements can impact housing construction, design, and financing. Innovations in construction materials and techniques can lead to more efficient and sustainable homes, potentially influencing pricing and market trends. The rise of online real estate platforms and virtual tours can facilitate more transparent and efficient transactions.

5. Environmental Sustainability:

Growing concerns about climate change and environmental sustainability are influencing housing preferences and construction practices. Demand for energy-efficient and eco-friendly homes is expected to increase, potentially impacting pricing and market trends.

6. Global Economic Factors:

Global economic conditions, including trade wars, currency fluctuations, and geopolitical events, can also influence the housing market. International investors and economic trends can impact domestic housing markets, particularly in areas with high foreign investment.

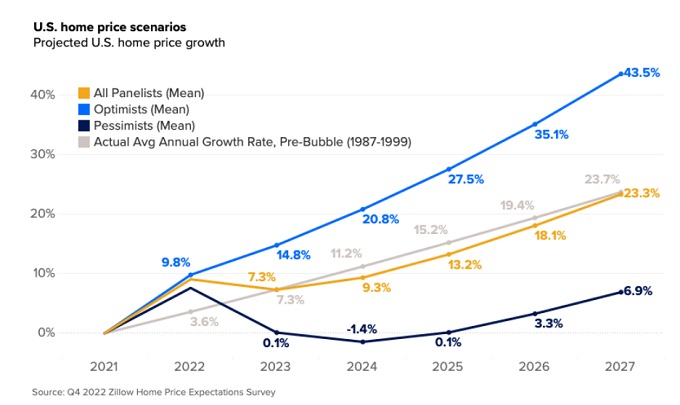

Potential Housing Market Scenarios in 2025:

Based on the factors discussed above, several potential scenarios for the housing market in 2025 can be envisioned:

Scenario 1: Continued Growth and Stable Prices:

This scenario assumes continued economic growth, moderate interest rate increases, and a steady population growth. In this scenario, housing demand remains robust, leading to stable or moderate price increases.

Scenario 2: Moderate Growth and Price Stabilization:

This scenario assumes moderate economic growth, gradual interest rate increases, and a slowing population growth. In this scenario, housing demand may moderate, leading to price stabilization or even slight price declines in some areas.

Scenario 3: Economic Slowdown and Price Correction:

This scenario assumes a slowdown in economic growth, potentially driven by factors such as rising inflation or geopolitical instability. In this scenario, higher interest rates and reduced consumer confidence could lead to a decrease in housing demand and a potential price correction.

Scenario 4: Housing Market Boom:

This scenario assumes strong economic growth, low interest rates, and a surge in population growth. In this scenario, housing demand could outpace supply, leading to significant price increases and potential housing shortages.

Implications for Buyers and Sellers in 2025:

Understanding the potential housing market scenarios in 2025 is crucial for both buyers and sellers.

For Buyers:

- Scenario 1 & 2: Buyers may face competitive markets with moderate price increases. It is crucial to secure pre-approval for a mortgage, carefully evaluate their financial situation, and be prepared to act quickly when finding suitable properties.

- Scenario 3: Buyers may have more leverage in negotiations, potentially finding more affordable properties. However, they should be prepared for potential economic uncertainty and its impact on their financial situation.

- Scenario 4: Buyers may face a challenging market with limited inventory and significant price increases. They should be prepared to be flexible in their search criteria and consider alternative housing options.

For Sellers:

- Scenario 1 & 2: Sellers can expect a strong market with potential for good returns on their investments. However, they should be aware of potential competition from other sellers and ensure their properties are well-maintained and priced competitively.

- Scenario 3: Sellers may need to adjust their expectations regarding selling prices. They should consult with real estate professionals to understand market conditions and develop a realistic pricing strategy.

- Scenario 4: Sellers are likely to benefit from a strong market with high demand. They should be prepared for multiple offers and potentially a quick sale.

FAQs about the Housing Market in 2025:

Q: What are the biggest factors that will influence housing prices in 2025?

A: The most significant factors will be economic growth, interest rate movements, population growth, and government policies.

Q: Will housing prices continue to rise in 2025?

A: The future of housing prices is uncertain and will depend on the interplay of various factors. It is possible that prices will continue to rise, stabilize, or even decline, depending on the economic and market conditions.

Q: Should I buy a house in 2025?

A: The decision to buy a house is a personal one that depends on individual financial circumstances and housing needs. Consulting with a financial advisor and a real estate professional can provide valuable insights and guidance.

Q: What are the risks associated with buying a house in 2025?

A: The risks associated with buying a house include potential price fluctuations, interest rate increases, and economic uncertainty. It is crucial to carefully evaluate your financial situation, consider the potential risks, and develop a sound investment strategy.

Tips for Navigating the Housing Market in 2025:

- Stay informed about current market trends and economic conditions.

- Consult with a financial advisor to assess your financial situation and determine your affordability.

- Work with a reputable real estate agent who understands local market conditions.

- Secure pre-approval for a mortgage before beginning your search.

- Be prepared to act quickly when finding suitable properties.

- Consider alternative housing options, such as renting or purchasing a smaller property.

Conclusion:

The housing market in 2025 will be shaped by a complex interplay of economic, social, and political factors. While predicting the future with certainty is impossible, analyzing current trends and potential influences allows for a reasoned outlook. Understanding the factors that will influence housing market dynamics, exploring potential scenarios, and considering the implications for buyers and sellers is crucial for making informed decisions in the coming years. By staying informed, being prepared, and working with experienced professionals, individuals can navigate the housing market effectively and make sound investment choices.

Closure

Thus, we hope this article has provided valuable insights into Forecasting the Housing Market in 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!