Navigating the Electric Vehicle Landscape: A Guide to the 2025 Federal Tax Credit

Navigating the Electric Vehicle Landscape: A Guide to the 2025 Federal Tax Credit

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Electric Vehicle Landscape: A Guide to the 2025 Federal Tax Credit. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Electric Vehicle Landscape: A Guide to the 2025 Federal Tax Credit

The transition to electric vehicles (EVs) is accelerating, spurred by environmental concerns, technological advancements, and government incentives. One such incentive is the federal tax credit, a financial advantage offered to individuals and businesses purchasing eligible EVs. While the current landscape of EV tax credits is dynamic, understanding the potential changes for 2025 is crucial for anyone considering an EV purchase.

The Current Landscape:

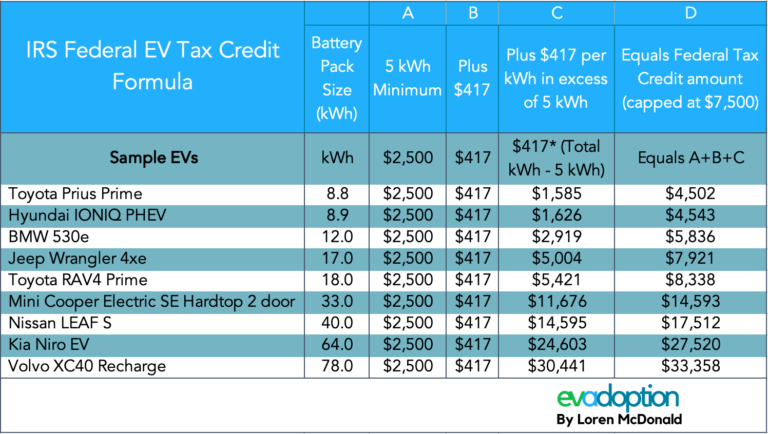

Currently, the federal tax credit for EVs is capped at $7,500. However, the Inflation Reduction Act (IRA) of 2022 introduced significant changes to the program, including stricter requirements for vehicle assembly and battery sourcing. These changes aim to promote domestic manufacturing and limit dependence on foreign supply chains.

Key Changes Under the IRA:

The IRA introduced several key changes to the EV tax credit, including:

- Income Limits: The credit is now subject to income limitations. Individuals with adjusted gross incomes above $150,000 and joint filers with incomes exceeding $300,000 are ineligible.

- Vehicle Assembly Requirements: The credit is only available for vehicles assembled in North America. This requirement aims to incentivize domestic manufacturing and support American jobs.

- Battery Sourcing Requirements: The credit is further contingent on the sourcing of critical battery components, including lithium, nickel, cobalt, and manganese. These minerals must be extracted or processed in the United States or a country with a free trade agreement with the US.

- Price Cap: The credit is limited to vehicles with a manufacturer’s suggested retail price (MSRP) of $55,000 for sedans and $80,000 for SUVs and pickup trucks.

The 2025 Outlook:

While the current EV tax credit is set to expire in 2032, the specifics of the program after 2025 remain uncertain. The IRA has introduced a new provision that allows for a potential extension of the credit based on certain conditions. These conditions include:

- Meeting Battery Sourcing Requirements: The credit will be extended if manufacturers meet specific battery sourcing requirements, including sourcing a certain percentage of critical minerals from the US or a free trade agreement partner.

- Domestic Assembly Requirements: The credit will also be extended if manufacturers meet specific requirements for domestic assembly of vehicles.

Implications for EV Buyers:

The evolving landscape of the EV tax credit presents both opportunities and challenges for potential buyers. While the IRA’s changes have created more stringent requirements, they also emphasize the importance of domestic manufacturing and sustainable battery sourcing. This trend is likely to continue in the future, with potential implications for the pricing and availability of EVs.

Navigating the Changes:

Here are some key considerations for anyone planning to purchase an EV in the coming years:

- Stay Informed: Keep abreast of the latest updates and regulations regarding the EV tax credit, as these can change rapidly.

- Check Eligibility: Carefully review the eligibility requirements for the tax credit, including income limitations, vehicle assembly, and battery sourcing.

- Consider Vehicle Price: Factor in the price cap for eligible vehicles, as this could affect your purchasing decisions.

- Explore Incentives: Research other state and local incentives that may be available in addition to the federal tax credit.

FAQs Regarding the 2025 EV Tax Credit:

Q: What is the current status of the EV tax credit?

A: The current EV tax credit is capped at $7,500 and is subject to various requirements, including income limitations, vehicle assembly, and battery sourcing. These requirements are outlined in the Inflation Reduction Act of 2022.

Q: Will the EV tax credit expire in 2025?

A: While the current EV tax credit is set to expire in 2032, the specific provisions for the program after 2025 are uncertain. The IRA has introduced a new provision that allows for a potential extension based on meeting certain requirements.

Q: What are the requirements for the extended tax credit?

A: The extension of the EV tax credit is contingent on manufacturers meeting specific battery sourcing and domestic assembly requirements. These requirements involve sourcing a certain percentage of critical minerals from the US or a free trade agreement partner and assembling vehicles in North America.

Q: How will the 2025 changes affect EV prices?

A: The changes to the EV tax credit could potentially influence EV prices. As manufacturers strive to meet the new requirements for battery sourcing and domestic assembly, the cost of production may increase, which could potentially translate to higher vehicle prices.

Q: Is it still worthwhile to purchase an EV in 2025?

A: The decision to purchase an EV is a personal one, and the benefits of owning an EV extend beyond the tax credit. EVs offer environmental benefits, lower operating costs, and technological advancements. However, it is crucial to consider the evolving landscape of the tax credit and its potential impact on your purchasing decision.

Tips for Navigating the 2025 EV Tax Credit:

- Research Thoroughly: Thoroughly research the latest updates and regulations regarding the EV tax credit, including eligibility criteria, vehicle assembly requirements, and battery sourcing.

- Compare Models: Compare different EV models to determine which ones meet the eligibility requirements for the tax credit and align with your budget and needs.

- Consult with a Tax Professional: Seek advice from a qualified tax professional to understand the implications of the tax credit and its potential impact on your tax liability.

- Explore Other Incentives: Investigate state and local incentives that may be available in addition to the federal tax credit, as these can further reduce the cost of purchasing an EV.

Conclusion:

The future of the EV tax credit beyond 2025 is uncertain, but one thing is clear: the program is evolving to encourage domestic manufacturing, sustainable battery sourcing, and a transition to a cleaner transportation sector. While the changes may present challenges, they also offer opportunities for those who are committed to embracing the future of electric mobility. By staying informed, understanding the evolving requirements, and exploring available incentives, individuals and businesses can make informed decisions about their EV purchases and contribute to a more sustainable future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Electric Vehicle Landscape: A Guide to the 2025 Federal Tax Credit. We appreciate your attention to our article. See you in our next article!