Navigating the Electric Vehicle Tax Credit Landscape: A Guide to 2025 Eligibility

Navigating the Electric Vehicle Tax Credit Landscape: A Guide to 2025 Eligibility

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Electric Vehicle Tax Credit Landscape: A Guide to 2025 Eligibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Electric Vehicle Tax Credit Landscape: A Guide to 2025 Eligibility

The Inflation Reduction Act of 2022 (IRA) significantly reshaped the electric vehicle (EV) tax credit landscape, introducing new eligibility requirements and limitations. Understanding these changes is crucial for individuals considering an EV purchase in 2025. This article provides a comprehensive overview of the current guidelines, outlining key factors that determine eligibility for the federal tax credit, as well as highlighting potential future developments.

Key Eligibility Criteria for the EV Tax Credit in 2025

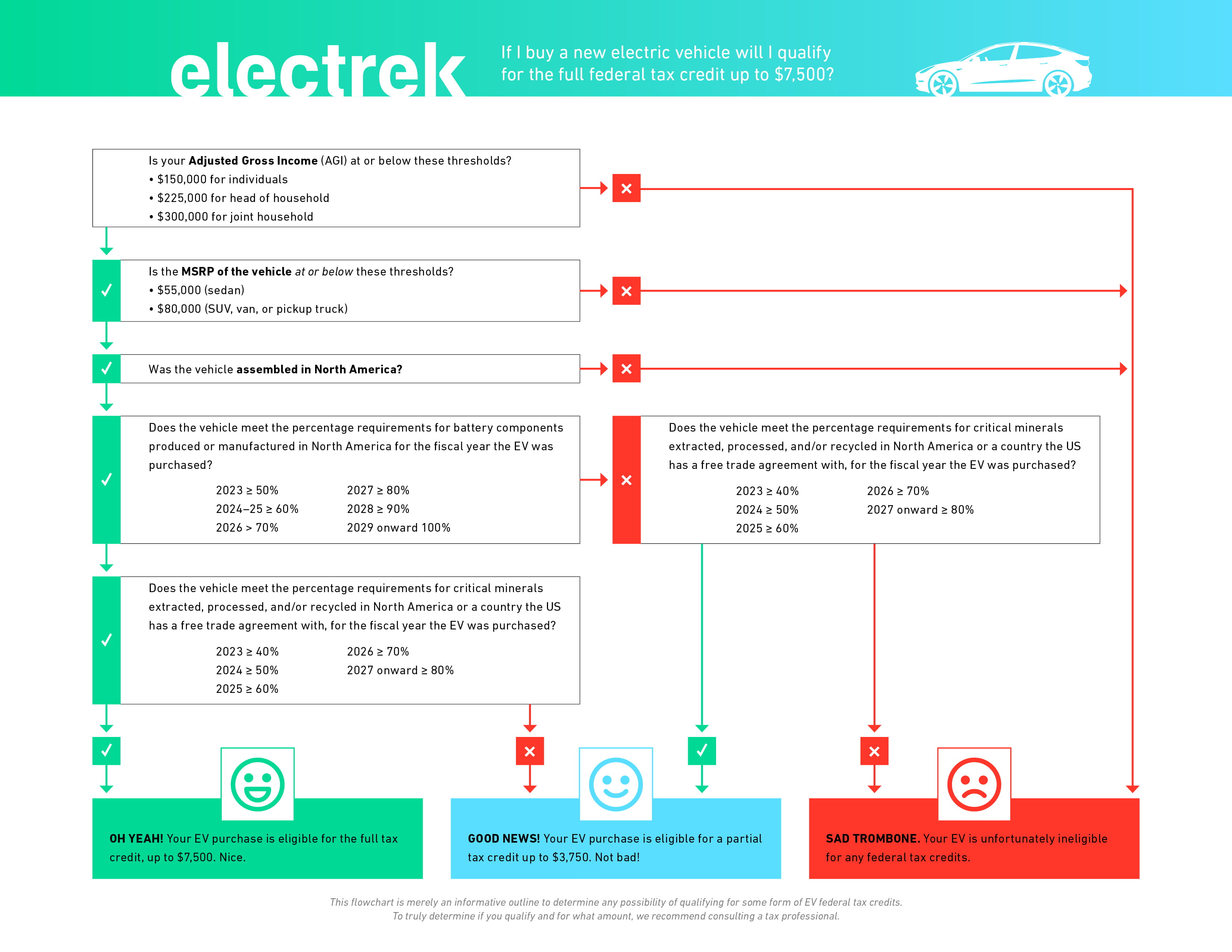

The current EV tax credit structure revolves around several key factors:

- Vehicle Price: The IRA imposes a maximum manufacturer’s suggested retail price (MSRP) for eligible vehicles. For SUVs, vans, and pickup trucks, the limit is $80,000, while for other vehicles, it is $55,000.

- Vehicle Assembly: To qualify for the full credit, the EV must be assembled in North America. This requirement aims to incentivize domestic manufacturing and job creation.

- Battery Component Sourcing: The IRA mandates that a certain percentage of battery components be sourced from North America or countries with free trade agreements with the United States. This includes critical minerals such as lithium, nickel, and cobalt.

- Income Limits: The IRA introduces income limitations for individuals claiming the tax credit. For single filers, the adjusted gross income (AGI) cannot exceed $150,000, while for married couples filing jointly, the limit is $300,000.

Understanding the Impact of the IRA’s Changes

The IRA’s changes have had a significant impact on the EV market:

- Increased Complexity: The new requirements have added complexity to the process of determining eligibility for the tax credit. Consumers now need to consider factors beyond the vehicle’s price, such as its assembly location and battery sourcing.

- Limited Availability: The stricter requirements have reduced the number of eligible vehicles, particularly those manufactured outside North America.

- Shift in Focus: The IRA’s focus on domestic manufacturing and battery sourcing has incentivized companies to invest in North American production and supply chains.

- Potential for Future Adjustments: The IRA’s provisions are subject to ongoing review and may be adjusted in the future.

Potential Future Developments

The EV tax credit landscape is constantly evolving, with potential changes on the horizon:

- Battery Sourcing Regulations: The Department of Energy (DOE) is expected to finalize regulations on battery sourcing requirements, providing greater clarity on the specific criteria that must be met.

- Critical Mineral Sourcing: The IRA’s provisions regarding critical mineral sourcing are subject to ongoing review and may be adjusted to reflect evolving geopolitical considerations.

- Inflation Adjustment: The price caps for eligible vehicles may be adjusted annually to account for inflation.

- Extension of the Credit: The IRA’s provisions are currently scheduled to expire in 2032, but Congress may consider extending the credit or making it permanent.

Navigating the EV Tax Credit Landscape: Tips for Consumers

For consumers considering an EV purchase, here are some key tips:

- Research Vehicle Eligibility: Thoroughly research the specific model you are interested in, verifying its assembly location, battery sourcing, and compliance with the IRA’s requirements.

- Consult with a Tax Professional: Consult with a qualified tax professional to understand the specific implications of the EV tax credit for your situation.

- Monitor Policy Updates: Stay informed about any changes to the EV tax credit program by following updates from the IRS and the DOE.

- Consider Alternative Incentives: Explore other federal, state, and local incentives that may be available for EV purchases.

FAQs on the EV Tax Credit

Q: What is the maximum tax credit amount available for EVs in 2025?

A: The maximum tax credit amount is $7,500 for qualifying EVs, subject to the eligibility criteria outlined above.

Q: How do I claim the EV tax credit?

A: You claim the credit when you file your federal income tax return. You will need to provide documentation from the vehicle manufacturer verifying the vehicle’s eligibility.

Q: What if I lease an EV?

A: The EV tax credit is generally only available to the owner of the vehicle, not the lessee. However, the manufacturer may pass on the credit to the lessee in the form of a lower lease payment.

Q: What happens if the price of an EV exceeds the MSRP limit?

A: If the MSRP of the EV exceeds the limit, it will not be eligible for the full tax credit. You may be eligible for a reduced credit amount based on the vehicle’s price.

Q: What happens if the battery components do not meet the sourcing requirements?

A: If the battery components do not meet the sourcing requirements, the vehicle may not be eligible for the full tax credit or any credit at all.

Conclusion

The EV tax credit is a valuable incentive for consumers considering an EV purchase. However, the IRA’s changes have introduced complexity and limitations that require careful consideration. By understanding the key eligibility criteria, staying informed about potential future developments, and consulting with a tax professional, consumers can navigate the EV tax credit landscape effectively and make informed decisions about their EV purchase.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Electric Vehicle Tax Credit Landscape: A Guide to 2025 Eligibility. We appreciate your attention to our article. See you in our next article!