Navigating the Electric Vehicle Tax Credit Landscape in 2025

Navigating the Electric Vehicle Tax Credit Landscape in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Electric Vehicle Tax Credit Landscape in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Electric Vehicle Tax Credit Landscape in 2025

The Inflation Reduction Act (IRA) of 2022 significantly revamped the federal tax credit for electric vehicles (EVs), introducing new eligibility criteria and limitations. While the act aimed to incentivize the production and purchase of domestically manufactured EVs, it also created a complex landscape for consumers seeking financial assistance. This article aims to provide clarity on the EV tax credit landscape as it stands in 2025, outlining the key factors that determine eligibility.

Understanding the Current Eligibility Criteria

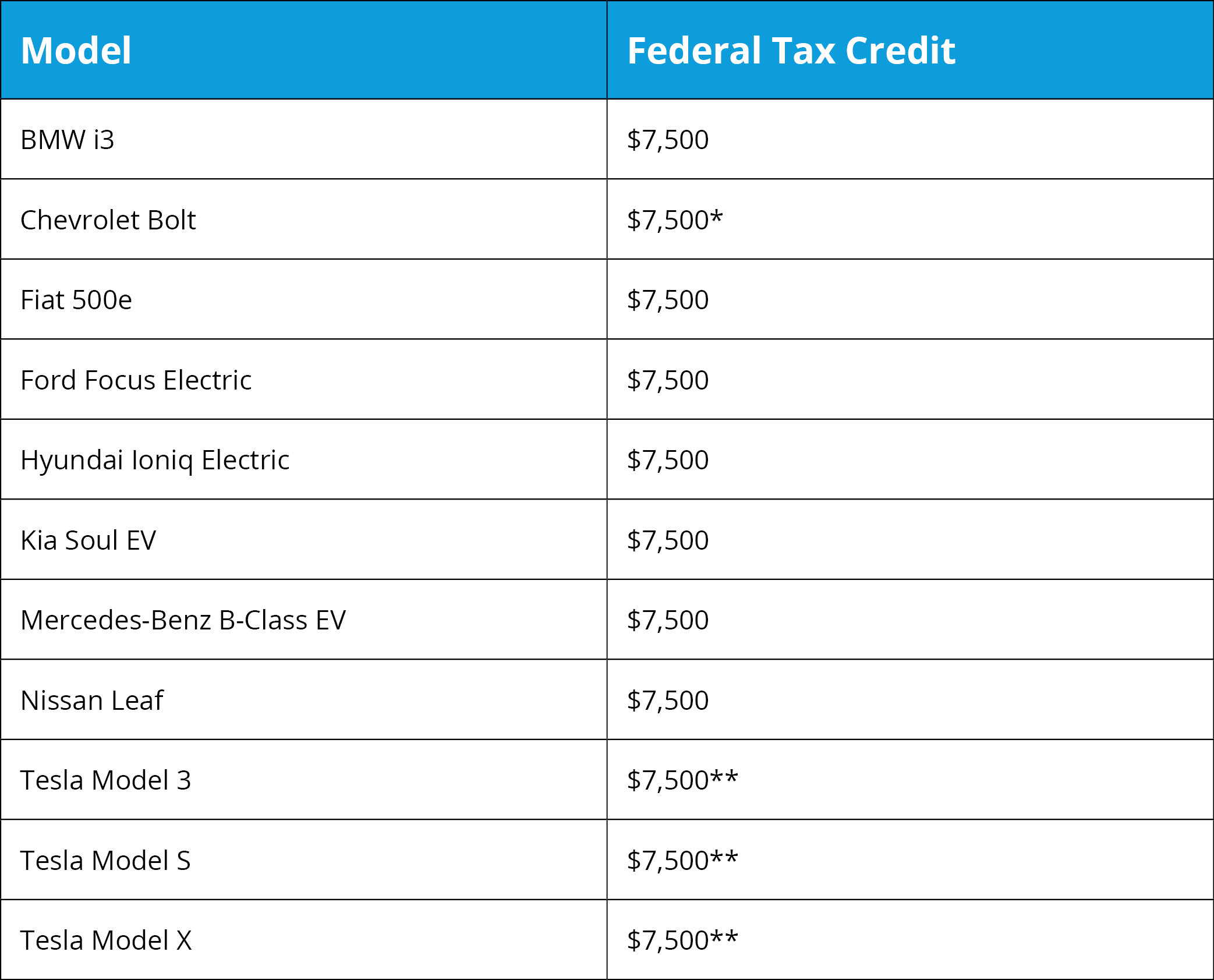

The IRA’s revised EV tax credit is a maximum of $7,500, available to individuals and families who purchase a new EV that meets specific requirements. The key criteria include:

- Vehicle Price: The MSRP of the EV must be under $55,000 for cars and $80,000 for SUVs, vans, and pickup trucks.

- Final Assembly Location: The EV must be assembled in North America.

- Battery Components: A minimum percentage of critical battery components must be sourced from North America or countries with free trade agreements with the U.S.

- Mineral Sourcing: A minimum percentage of battery minerals must be extracted or processed in North America or countries with free trade agreements with the U.S.

- Income Limitations: The tax credit is phased out for higher-income earners.

The Shifting Landscape of EV Eligibility

The IRA’s requirements have significantly impacted the EV market. Many popular models previously eligible for the full tax credit no longer qualify due to their assembly location or battery sourcing. This has led to a dynamic situation, with manufacturers scrambling to adjust their supply chains and production processes to comply with the new rules.

The 2025 Outlook: Navigating the New Rules

As we approach 2025, the EV market continues to evolve. The following factors will shape the landscape:

- Increased Domestic Production: Manufacturers are investing heavily in domestic production facilities to meet the new assembly requirements. This will likely lead to an increase in the number of eligible vehicles.

- Battery Sourcing: The sourcing requirements for critical battery components and minerals are complex and evolving. Manufacturers are working to secure reliable and compliant supply chains, which will likely influence the availability of eligible EVs.

- Income Limits: The phase-out of the tax credit for higher-income earners will continue to influence the affordability of EVs for certain demographics.

Navigating the Tax Credit Maze: Resources and Considerations

For consumers interested in purchasing an EV, navigating the tax credit landscape can be challenging. The following resources and considerations can help:

- IRS Website: The Internal Revenue Service (IRS) website provides detailed information on the EV tax credit, including eligibility requirements and guidance on claiming the credit.

- Vehicle Manufacturer Websites: Most EV manufacturers have updated their websites with information on which models qualify for the tax credit and the specific requirements they meet.

- Third-Party Resources: Several websites and organizations provide independent analysis and guidance on EV tax credit eligibility.

Conclusion: The Future of EV Tax Incentives

The EV tax credit, while complex, remains a significant incentive for consumers considering the purchase of an electric vehicle. As the landscape continues to evolve, staying informed about the latest requirements and eligible models is crucial. The IRA’s focus on domestic production and sourcing is likely to have a long-term impact on the EV market, encouraging innovation and investment in the United States.

FAQs

Q: What is the maximum EV tax credit available in 2025?

A: The maximum EV tax credit is $7,500. However, meeting all the eligibility requirements is crucial to claiming the full amount.

Q: Is there a limit on the number of EVs I can purchase and claim the tax credit for?

A: There is no limit on the number of EVs you can purchase, but you can only claim the tax credit once per household per year.

Q: What if I purchase an EV that was previously eligible for the full tax credit but now only qualifies for a partial credit?

A: The amount of the tax credit will be based on the requirements met by the vehicle at the time of purchase.

Q: How do I claim the EV tax credit?

A: The tax credit is claimed on Form 8997, which you file with your federal income tax return.

Q: What if I purchase an EV from a private seller?

A: The EV tax credit is only available for the purchase of new EVs from a dealer.

Q: What if I lease an EV?

A: The EV tax credit is not available for leased vehicles.

Tips

- Research thoroughly: Before purchasing an EV, thoroughly research the eligibility requirements and available models.

- Consult with a tax professional: For complex situations or questions about claiming the tax credit, consult with a qualified tax professional.

- Stay updated: The EV tax credit landscape is constantly evolving. Stay informed about the latest requirements and changes.

- Consider the long-term costs: While the tax credit can significantly reduce the upfront cost of an EV, consider the long-term costs of ownership, including charging, maintenance, and potential battery replacement.

Conclusion:

The EV tax credit landscape is complex and subject to change. However, by understanding the key requirements and staying informed, consumers can navigate the process and potentially benefit from significant financial savings on the purchase of a new EV. As the United States transitions towards a more sustainable future, the EV tax credit will likely continue to play a vital role in promoting the adoption of electric vehicles.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Electric Vehicle Tax Credit Landscape in 2025. We thank you for taking the time to read this article. See you in our next article!