Navigating the Electric Vehicle Tax Credit Landscape in 2025

Navigating the Electric Vehicle Tax Credit Landscape in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Electric Vehicle Tax Credit Landscape in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Electric Vehicle Tax Credit Landscape in 2025

The United States government, through the Inflation Reduction Act (IRA) of 2022, has significantly revised the existing tax credit for electric vehicles (EVs). These changes, which will come into full effect in 2025, introduce a new set of criteria and limitations, making it essential for prospective EV buyers to understand the evolving landscape.

Key Changes Introduced by the IRA:

The IRA’s impact on the EV tax credit is multifaceted. Here are some of the most notable changes:

- Income Limits: The tax credit will be capped for individuals earning over $150,000 and joint filers earning over $300,000 annually. This means higher-income earners may not be eligible for the full credit amount.

- Vehicle Price Caps: The tax credit will only apply to vehicles with a manufacturer’s suggested retail price (MSRP) under $55,000 for sedans and $80,000 for SUVs and pickup trucks. This limitation could exclude some luxury EVs from eligibility.

- Domestic Manufacturing and Mineral Sourcing: The IRA mandates that a significant portion of the battery components and minerals used in eligible EVs must be sourced and manufactured within North America. This requirement is expected to increase the cost of production for some manufacturers, potentially impacting the final vehicle price.

- Phased-Out Credit: The credit will be phased out for manufacturers who have sold over 200,000 EVs. This provision aims to ensure the benefits of the credit are distributed more equitably across the EV market.

Understanding the Impact of the Changes:

The changes introduced by the IRA are designed to promote the domestic production of EVs and their components, while also ensuring that the tax credit benefits a wider range of consumers. However, these changes also create complexities for potential EV buyers, as the eligibility criteria become more stringent.

Eligibility Criteria for the 2025 EV Tax Credit:

To qualify for the EV tax credit in 2025, a vehicle must meet the following criteria:

- MSRP: The vehicle’s MSRP must be below the specified thresholds for sedans ($55,000) and SUVs/trucks ($80,000).

- Battery Component and Mineral Sourcing: A significant portion of the battery components and minerals used in the vehicle must be sourced and manufactured in North America.

- Income: The individual or joint filers’ income must be below the specified thresholds.

- Manufacturer’s Sales: The vehicle manufacturer must not have exceeded the 200,000 EV sales threshold.

Benefits of the EV Tax Credit:

The EV tax credit offers significant financial incentives for consumers considering the purchase of an EV. The credit can substantially offset the initial cost of an EV, making it a more affordable option.

Navigating the 2025 EV Tax Credit Landscape:

The evolving landscape of the EV tax credit can be challenging to navigate. To ensure eligibility for the credit, potential EV buyers should:

- Research Vehicle Eligibility: Thoroughly research the specific models that meet the 2025 eligibility criteria, including MSRP, battery sourcing requirements, and manufacturer’s sales.

- Consult with Tax Professionals: Seek advice from qualified tax professionals to understand the application process and potential deductions.

- Stay Updated on Policy Changes: Monitor changes to the EV tax credit regulations, as they are subject to ongoing updates and interpretations.

Frequently Asked Questions (FAQs) about the 2025 EV Tax Credit:

Q: Who is eligible for the EV tax credit in 2025?

A: Individuals and joint filers with incomes below the specified thresholds ($150,000 and $300,000, respectively) who purchase eligible EVs meeting the MSRP, battery sourcing, and manufacturer’s sales requirements.

Q: What are the income limits for the EV tax credit in 2025?

A: Individuals must earn less than $150,000 and joint filers must earn less than $300,000 annually to qualify for the full credit.

Q: How much is the EV tax credit in 2025?

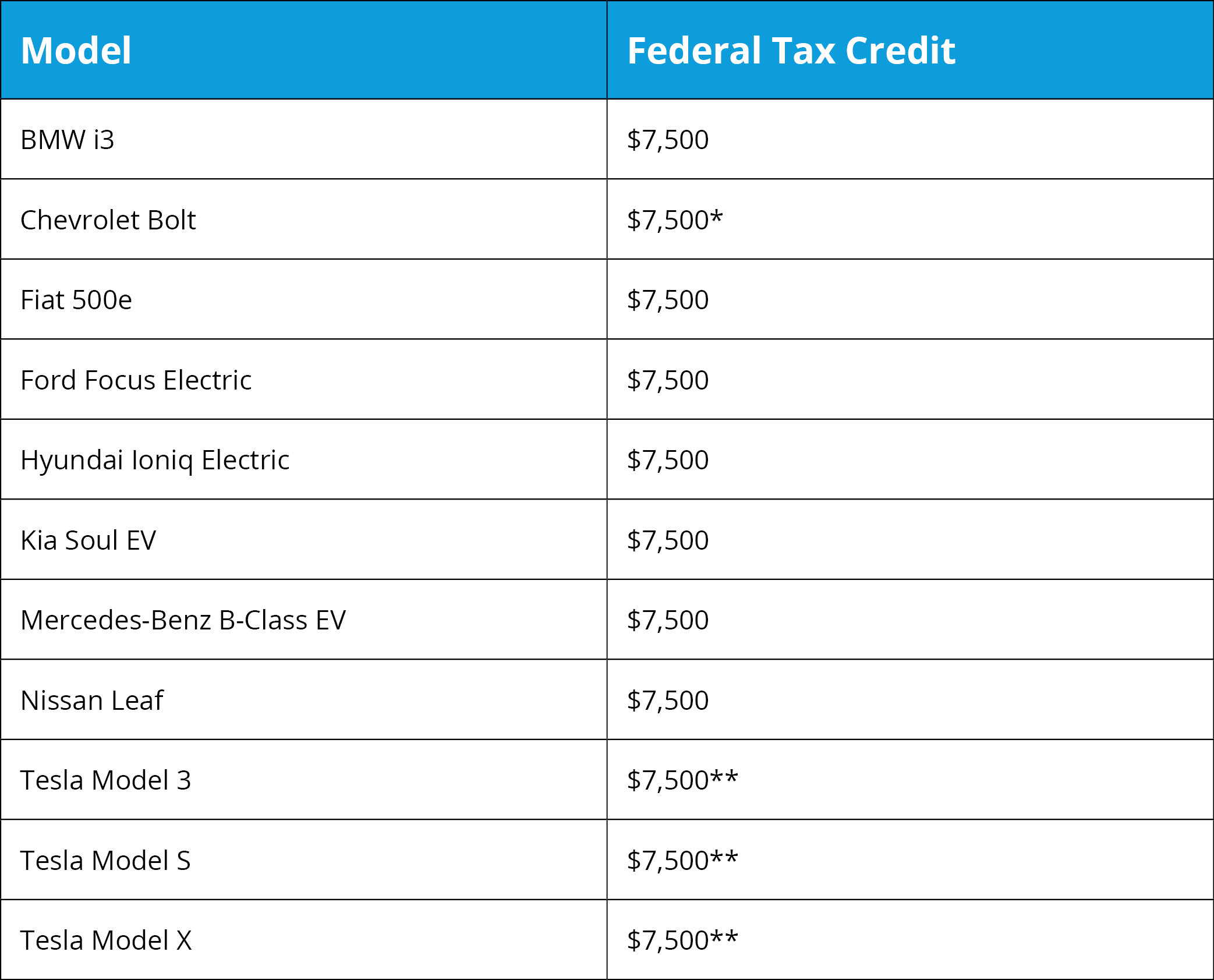

A: The credit amount varies depending on the specific vehicle and the battery capacity, but can be up to $7,500.

Q: What vehicles are eligible for the EV tax credit in 2025?

A: Vehicles that meet the MSRP, battery sourcing, and manufacturer’s sales requirements are eligible.

Q: How do I claim the EV tax credit on my tax return?

A: You will need to complete Form 8936, "Credit for Qualified Electric Vehicles," and attach it to your federal income tax return.

Q: What happens if the manufacturer of my EV has exceeded the 200,000 EV sales threshold?

A: If the manufacturer has exceeded the threshold, the credit may be reduced or phased out for vehicles purchased after the threshold is reached.

Q: What if my EV does not meet the battery sourcing requirements?

A: If the vehicle does not meet the battery sourcing requirements, it may not qualify for the full credit amount or may not be eligible at all.

Tips for Navigating the 2025 EV Tax Credit:

- Research Vehicle Eligibility: Thoroughly research the specific models that meet the 2025 eligibility criteria, including MSRP, battery sourcing requirements, and manufacturer’s sales.

- Consult with Tax Professionals: Seek advice from qualified tax professionals to understand the application process and potential deductions.

- Stay Updated on Policy Changes: Monitor changes to the EV tax credit regulations, as they are subject to ongoing updates and interpretations.

- Consider Leasing: Leasing an EV may offer tax benefits, as the manufacturer, rather than the individual, is responsible for meeting the eligibility requirements.

- Explore Alternative Incentives: Investigate state and local incentives that may be available in addition to the federal tax credit.

Conclusion:

The 2025 EV tax credit, while offering significant financial incentives, presents a complex landscape for prospective EV buyers. Understanding the eligibility criteria, navigating the changing regulations, and seeking professional advice are crucial for maximizing the benefits of this incentive. The evolving nature of the tax credit underscores the need for continued research and vigilance to ensure informed decision-making in the transition towards a more sustainable transportation future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Electric Vehicle Tax Credit Landscape in 2025. We thank you for taking the time to read this article. See you in our next article!