Navigating the Electric Vehicle Tax Credit Landscape in 2025

Navigating the Electric Vehicle Tax Credit Landscape in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Electric Vehicle Tax Credit Landscape in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Electric Vehicle Tax Credit Landscape in 2025

The United States government has implemented a series of incentives to encourage the adoption of electric vehicles (EVs), primarily through the federal tax credit program. While the specifics of the program have been subject to change, it remains a significant factor in the decision-making process for potential EV buyers. Understanding the current landscape and potential future iterations is essential for making informed choices.

The Current Landscape:

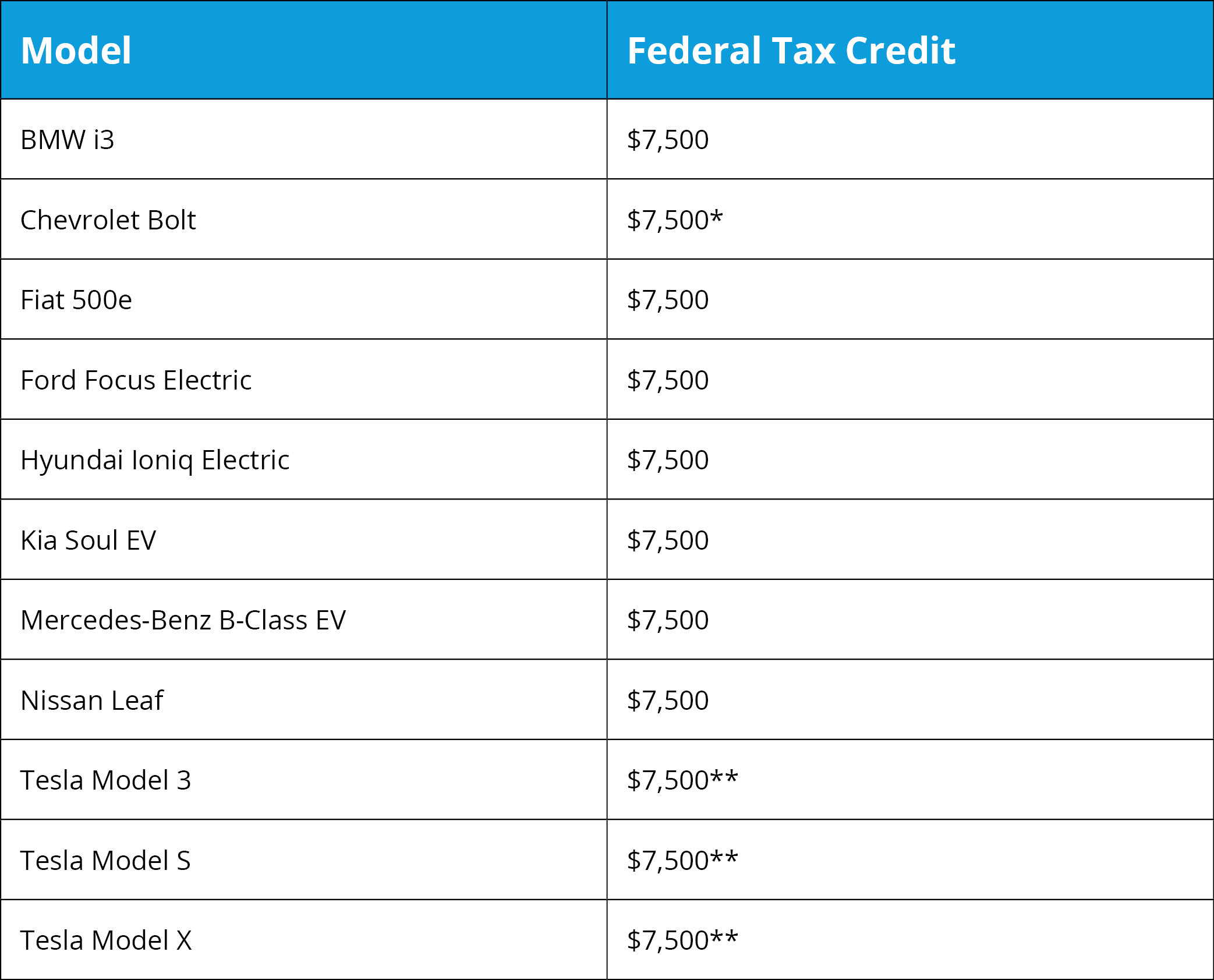

As of 2023, the EV tax credit is capped at $7,500 for most vehicles. However, several factors influence eligibility, including:

- Vehicle MSRP: The credit is generally available for vehicles with a manufacturer’s suggested retail price (MSRP) below a certain threshold, which varies based on vehicle type.

- Battery sourcing and assembly: The credit is subject to restrictions on the sourcing of battery components, with a focus on North American manufacturing and sourcing.

- Vehicle manufacturer: Certain manufacturers have reached the production cap for eligible vehicles, making their EVs ineligible for the tax credit.

These factors, combined with the evolving nature of the program, create a dynamic landscape that necessitates ongoing monitoring.

Looking Ahead to 2025:

The Inflation Reduction Act of 2022 introduced significant changes to the EV tax credit program, which will come into full effect in 2025. These changes aim to further incentivize domestic production and manufacturing, creating a new set of criteria for eligibility.

Key Changes in 2025:

- Increased Credit Amount: The maximum credit amount is expected to increase to $10,000 for certain vehicles.

- Revised MSRP Thresholds: The MSRP thresholds for eligibility will be adjusted, potentially impacting the availability of the credit for higher-priced vehicles.

- Stricter Battery Sourcing Requirements: The sourcing requirements for battery components will become more stringent, emphasizing North American manufacturing and critical mineral sourcing.

- Income Limits: Income limitations may be introduced, potentially limiting eligibility for higher-income earners.

- Production Caps: New production caps may be implemented, affecting the eligibility of vehicles from certain manufacturers.

Understanding the Impact:

These changes will have a significant impact on the EV market in 2025 and beyond. Manufacturers are actively adjusting their production processes and sourcing strategies to comply with the evolving requirements. Consumers will need to carefully consider the updated eligibility criteria when making purchasing decisions.

Navigating the 2025 Landscape:

To effectively navigate the 2025 EV tax credit landscape, potential buyers should:

- Monitor the evolving regulations: Stay informed about the latest updates to the EV tax credit program and its implications for eligible vehicles.

- Research vehicle eligibility: Carefully research the specific eligibility criteria for each EV model under consideration.

- Consider long-term implications: Evaluate the impact of the tax credit on the overall cost of ownership, taking into account potential changes in eligibility over time.

- Consult with a tax professional: Seek guidance from a qualified tax professional to ensure accurate understanding of the tax credit and its implications for individual circumstances.

FAQs Regarding 2025 EV Tax Credits:

Q: What types of EVs will qualify for the tax credit in 2025?

A: The specific types of EVs eligible for the tax credit in 2025 will depend on the final regulations. However, the focus is expected to be on vehicles with a significant North American manufacturing and battery sourcing component.

Q: What is the maximum credit amount in 2025?

A: The maximum credit amount is expected to be $10,000 for certain vehicles, subject to meeting the eligibility criteria.

Q: How will the income limits affect eligibility?

A: The specific income limits for eligibility are still being determined. However, it is expected that higher-income earners may be subject to limitations.

Q: What is the impact of the production caps on eligibility?

A: Production caps may limit the number of vehicles eligible for the tax credit from certain manufacturers.

Tips for Maximizing the 2025 EV Tax Credit:

- Prioritize North American-made vehicles: Choose EVs with a significant North American manufacturing component to increase the likelihood of eligibility.

- Consider vehicles with eligible battery sourcing: Ensure the battery components meet the sourcing requirements outlined in the 2025 regulations.

- Monitor manufacturer announcements: Stay informed about updates from vehicle manufacturers regarding the eligibility of their models.

- Seek professional tax advice: Consult with a qualified tax professional to understand the specific implications of the tax credit for your individual circumstances.

Conclusion:

The EV tax credit program is a significant incentive for consumers considering the transition to electric vehicles. The evolving landscape, particularly the changes implemented through the Inflation Reduction Act of 2022, will continue to shape the market dynamics. By staying informed about the updated eligibility criteria and considering the long-term implications of the program, potential EV buyers can make informed decisions that maximize the benefits of the tax credit while contributing to the broader adoption of sustainable transportation solutions.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Electric Vehicle Tax Credit Landscape in 2025. We hope you find this article informative and beneficial. See you in our next article!