Navigating the Electric Vehicle Tax Credit Landscape in 2025

Navigating the Electric Vehicle Tax Credit Landscape in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Electric Vehicle Tax Credit Landscape in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Electric Vehicle Tax Credit Landscape in 2025

The United States is actively promoting the adoption of electric vehicles (EVs) through various initiatives, including tax credits. While the specifics of these incentives are subject to change, understanding the current landscape and potential future adjustments is crucial for both consumers and the automotive industry. This article provides a comprehensive overview of the EV tax credit situation in 2025, exploring its implications and potential benefits.

Current State of the EV Tax Credit

The Inflation Reduction Act of 2022 significantly revamped the existing EV tax credit program. This legislation introduced new requirements and limitations, aiming to incentivize the production of EVs in the United States while promoting domestic sourcing of critical minerals and battery components.

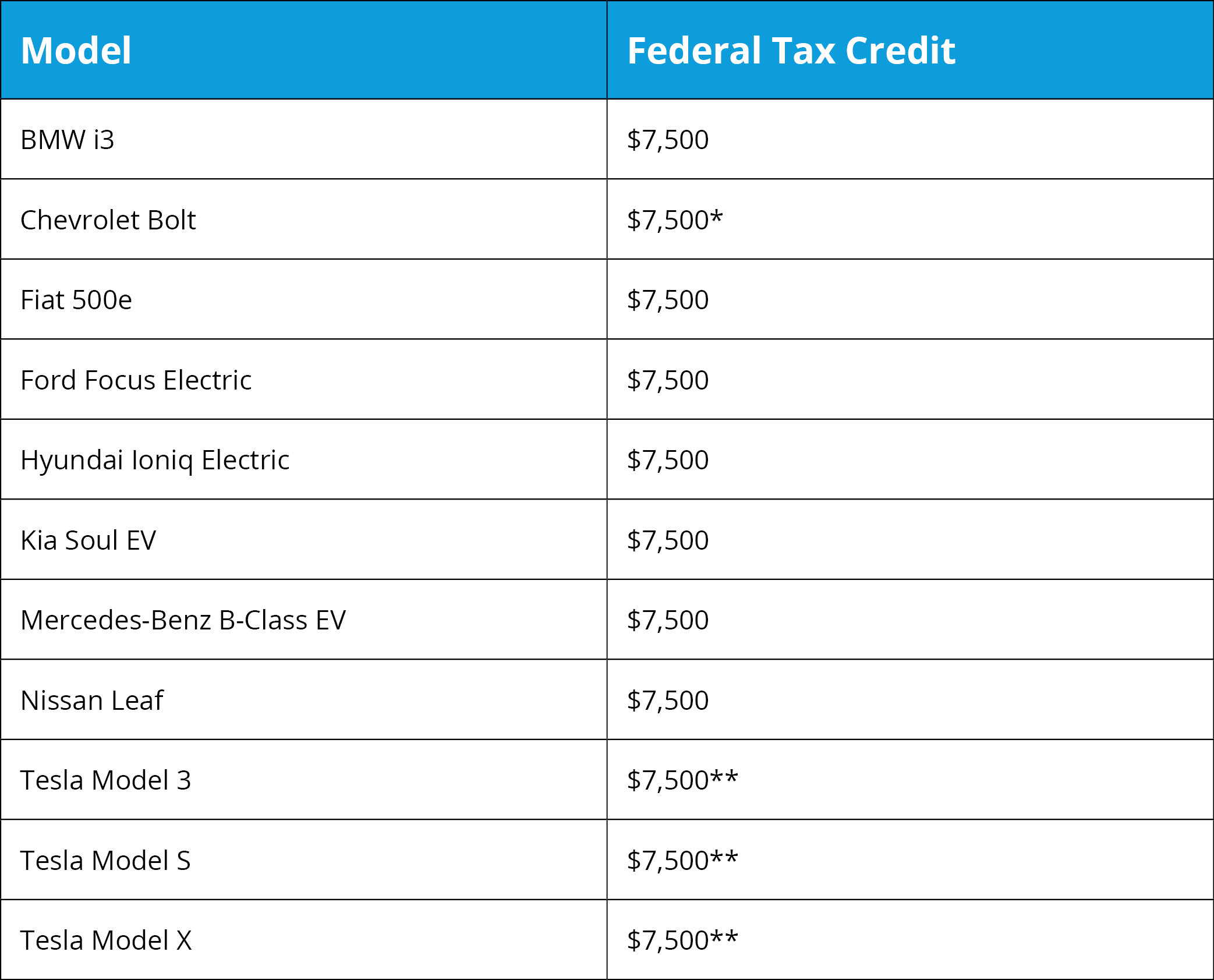

Under the revised program, the tax credit is capped at $7,500 per vehicle. However, eligibility is contingent upon various factors, including:

- Vehicle Price: The maximum eligible MSRP for SUVs, pickup trucks, and vans is $80,000, while the limit for other vehicles is $55,000.

- Final Assembly: The vehicle must be assembled in North America.

- Battery Component Sourcing: A significant portion of the battery components must be sourced from North America or countries with free trade agreements with the United States.

- Critical Mineral Sourcing: A significant portion of the critical minerals used in the battery must be extracted or processed in the United States or countries with free trade agreements.

- Income Limits: There are income limitations for claiming the tax credit, with individuals exceeding certain thresholds ineligible for the full amount.

Potential Changes in 2025

The current EV tax credit program is subject to ongoing review and potential adjustments. While the specifics of future changes remain uncertain, several key areas may be addressed:

- Increased Domestic Production Requirements: The sourcing requirements for battery components and critical minerals may become more stringent, potentially emphasizing domestic production and further incentivizing the development of a robust domestic EV supply chain.

- Modifications to Income Limits: The income thresholds for claiming the tax credit could be revised, potentially expanding eligibility to a broader range of individuals.

- Extension of the Program: The current tax credit program is set to expire in 2032. However, there is ongoing discussion about potentially extending the program or introducing new incentives to further accelerate EV adoption.

Implications for Consumers

The EV tax credit program directly impacts consumers considering purchasing an electric vehicle. The availability and amount of the tax credit can significantly reduce the upfront cost of an EV, making it a more attractive option compared to traditional gasoline-powered vehicles.

However, consumers should be aware of the evolving eligibility criteria and potential changes to the program. It is essential to stay informed about the latest updates and regulations to ensure they meet the requirements for claiming the tax credit.

Implications for the Automotive Industry

The EV tax credit program plays a crucial role in shaping the future of the automotive industry in the United States. The incentives encourage manufacturers to invest in domestic production, research and development, and the creation of a robust EV ecosystem.

The program also incentivizes innovation and technological advancements in the EV sector, driving the development of more affordable, efficient, and technologically advanced electric vehicles.

FAQs about the 2025 EV Tax Credit

Q: Will the EV tax credit still be available in 2025?

A: While the current program is set to expire in 2032, there is a possibility of extension or adjustments to the program. It is advisable to stay informed about any potential changes in the coming years.

Q: What vehicles are eligible for the EV tax credit in 2025?

A: Eligibility is subject to evolving regulations, including vehicle price, assembly location, battery component sourcing, and critical mineral sourcing. It is crucial to consult with the relevant authorities or automotive manufacturers for the most up-to-date information.

Q: How much can I save with the EV tax credit in 2025?

A: The maximum tax credit amount is $7,500, but eligibility is contingent upon meeting various requirements. The actual amount of the tax credit may vary depending on individual circumstances.

Q: What are the income limits for claiming the EV tax credit in 2025?

A: The income thresholds for claiming the full tax credit are subject to change. It is recommended to consult with the Internal Revenue Service (IRS) or a tax professional for the most accurate information.

Tips for Navigating the EV Tax Credit in 2025

- Stay Informed: Continuously monitor developments in the EV tax credit program through official government sources, automotive industry publications, and reputable news outlets.

- Consult with a Tax Professional: Seek guidance from a qualified tax professional to ensure accurate understanding of the program’s requirements and potential benefits.

- Research Eligible Vehicles: Carefully research EV models that meet the eligibility criteria for the tax credit, considering factors such as price, range, and features.

- Consider Long-Term Value: Evaluate the total cost of ownership, including the tax credit, over the lifetime of the vehicle to make an informed purchasing decision.

Conclusion

The EV tax credit program is a dynamic and evolving policy landscape. While the specifics of the program in 2025 remain uncertain, it is clear that the incentives play a critical role in promoting the adoption of electric vehicles, fostering domestic production, and shaping the future of the automotive industry. By staying informed, understanding the eligibility requirements, and consulting with relevant experts, consumers and businesses can navigate this evolving landscape and leverage the potential benefits of the EV tax credit program.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Electric Vehicle Tax Credit Landscape in 2025. We appreciate your attention to our article. See you in our next article!