The Evolving Landscape of Electric Vehicle Taxation in 2025

The Evolving Landscape of Electric Vehicle Taxation in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Evolving Landscape of Electric Vehicle Taxation in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolving Landscape of Electric Vehicle Taxation in 2025

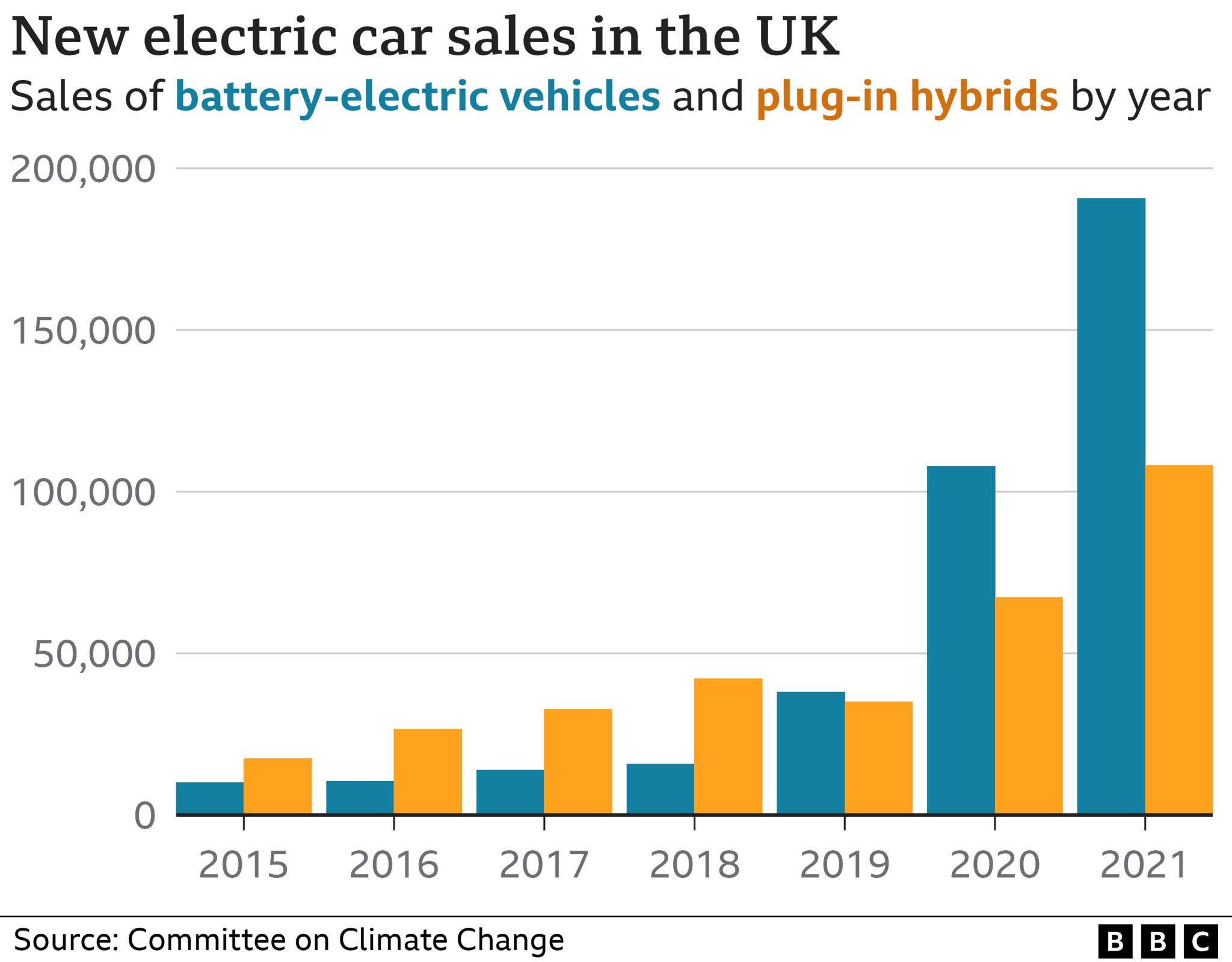

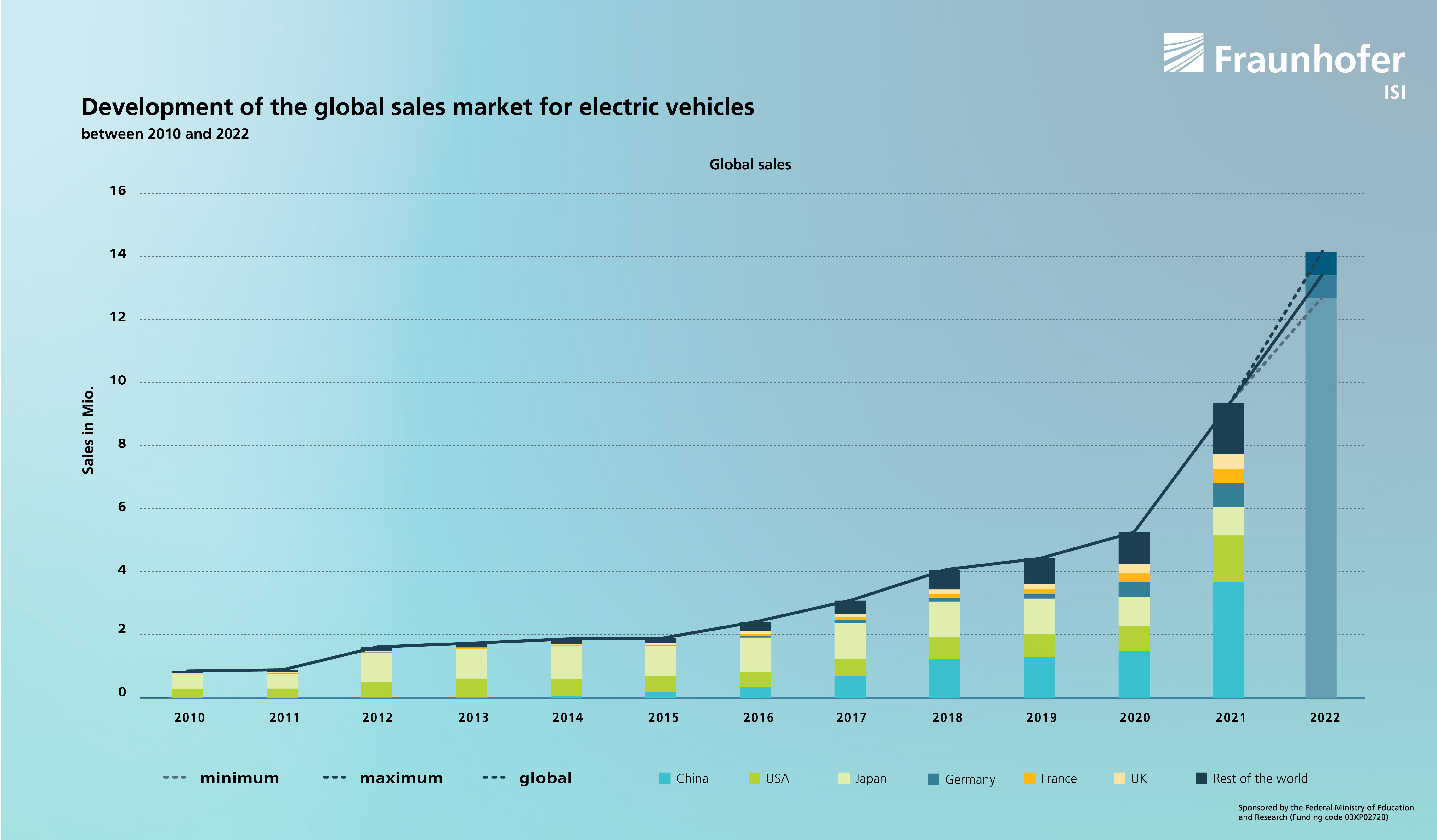

The automotive landscape is rapidly shifting towards electric vehicles (EVs), driven by environmental concerns and technological advancements. As the adoption of EVs accelerates, governments worldwide are adjusting their taxation policies to encourage this transition and ensure a sustainable future. This article delves into the evolving landscape of EV taxation in 2025, examining the key factors influencing these policies and their potential implications.

The Shifting Paradigm of EV Taxation

Historically, EV taxation has been largely exempt or subsidized, reflecting the nascent stage of the EV market and the desire to incentivize adoption. However, as EV sales surge and become more mainstream, the focus is shifting towards a more equitable and sustainable taxation model. This shift is motivated by several key factors:

- Environmental Concerns: While EVs emit zero tailpipe emissions, their production and battery disposal processes generate carbon footprints. Governments are increasingly recognizing the need to address these environmental impacts through taxation.

- Fiscal Sustainability: As EV adoption grows, traditional fuel taxes, which fund road maintenance and public transportation, are declining. Governments are seeking alternative revenue streams to maintain these essential services.

- Equity and Fairness: The exemption of EVs from traditional taxes has raised concerns about fairness, as gasoline-powered vehicles continue to shoulder the burden of road maintenance and environmental costs.

- Market Maturity: With EV technology maturing and costs decreasing, the need for significant subsidies is diminishing. Governments are transitioning towards more neutral taxation policies that reflect the true cost of EV ownership.

Key Trends in EV Taxation in 2025

Several trends are shaping the future of EV taxation in 2025:

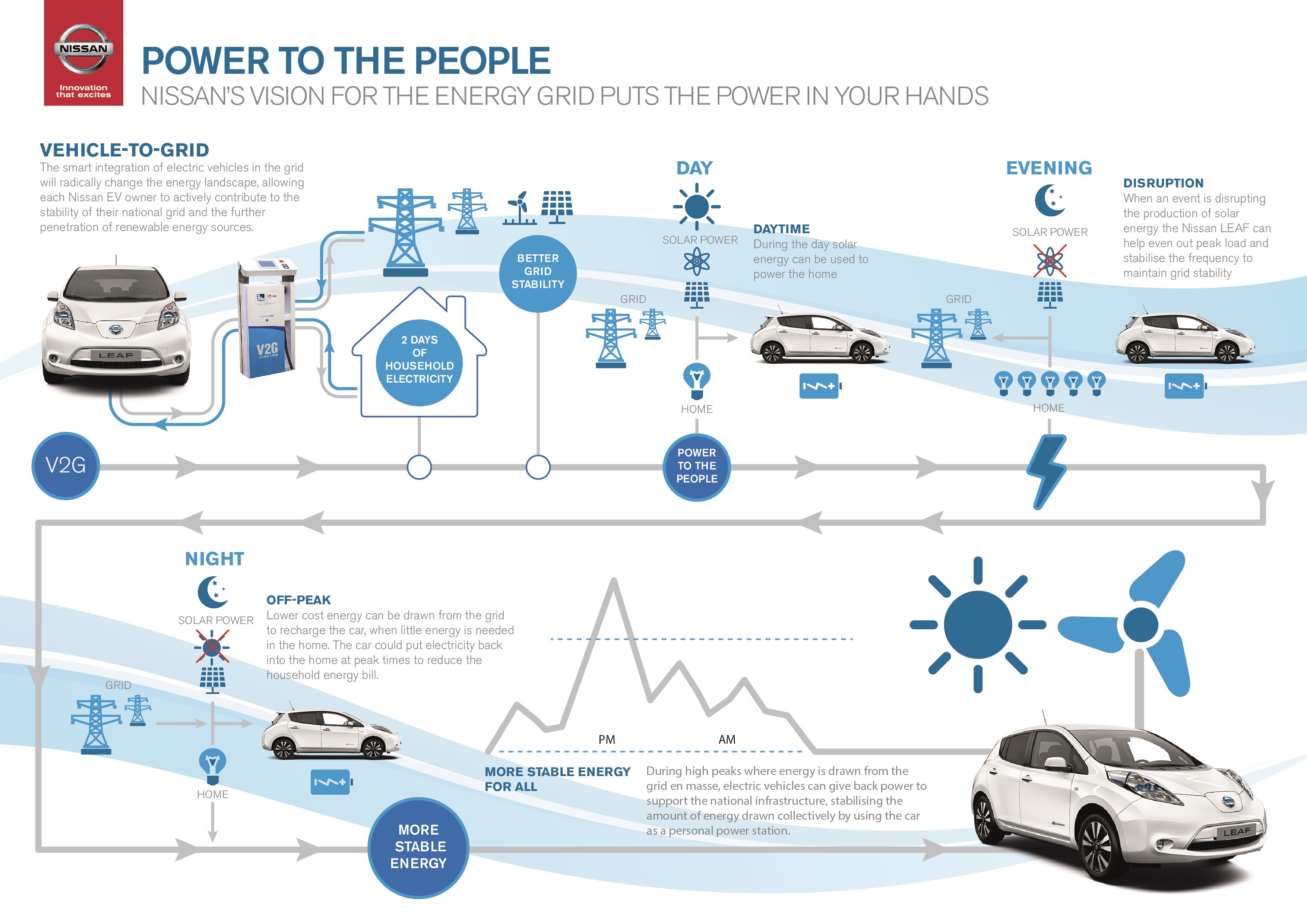

- Road Usage Charges: Instead of fuel taxes, many jurisdictions are exploring road usage charges based on distance traveled or vehicle weight. This approach aligns with the "polluter pays" principle and ensures that all vehicles contribute to road infrastructure maintenance.

- Taxation Based on Vehicle Emissions: Some countries are introducing emissions-based taxation for EVs, taking into account their production and disposal footprint. This approach incentivizes the development and adoption of cleaner manufacturing processes and battery recycling technologies.

- Targeted Incentives: While blanket exemptions are fading, targeted incentives for specific EV types, such as those with longer ranges or lower emissions, may persist. This approach encourages the development of more advanced and sustainable EV models.

- Regional Variations: Due to diverse environmental priorities, economic conditions, and infrastructure development, EV taxation policies will likely vary significantly across regions.

The Importance of a Comprehensive Approach

The transition towards a sustainable and equitable EV taxation system requires a comprehensive approach that considers:

- Transparency and Predictability: Governments need to communicate clearly their EV taxation policies and ensure a stable framework to foster long-term investment and consumer confidence.

- Phased Implementation: Gradual implementation of new policies allows for adaptation and minimizes disruption to the market.

- Public Engagement: Engaging stakeholders, including industry players, consumers, and environmental groups, ensures that policies are developed with a broad understanding of the implications.

- Flexibility and Adaptability: As technology evolves and consumer preferences shift, taxation policies need to be flexible and adaptable to remain effective.

Frequently Asked Questions about EV Taxation in 2025

Q1: Will EVs be taxed the same as gasoline-powered vehicles in 2025?

A: It is unlikely that EVs will be taxed identically to gasoline-powered vehicles in 2025. The taxation approach will likely vary depending on the jurisdiction and the specific policy framework adopted. However, a trend towards more equitable and sustainable taxation systems is expected, where EVs contribute to road maintenance and environmental costs.

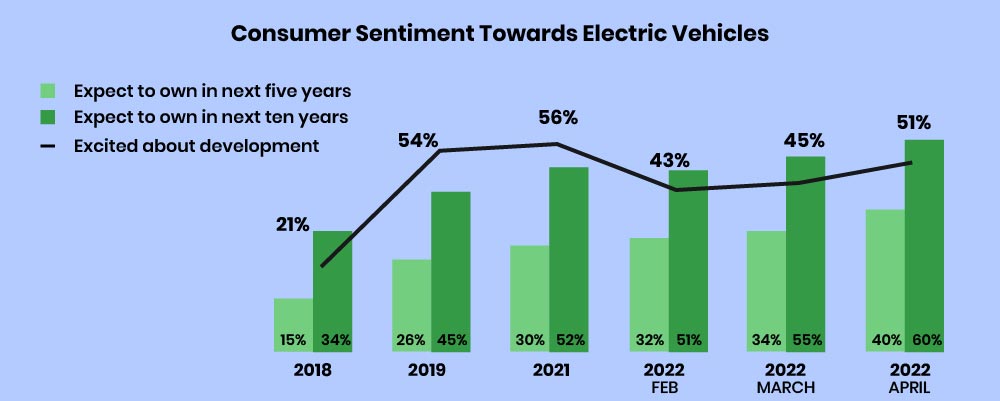

Q2: What are the potential impacts of EV taxation on consumer adoption?

A: The impact of EV taxation on consumer adoption will depend on the specific policies implemented. While increased taxes may discourage some consumers, others may be motivated by the environmental benefits of EVs or the potential for lower overall operating costs.

Q3: How will EV taxation influence the development of the EV market?

A: Taxation policies can influence the development of the EV market in several ways. Tax incentives for specific EV types can encourage innovation and the adoption of cleaner technologies. Conversely, higher taxes on EVs could hinder market growth.

Q4: What are the challenges associated with implementing EV taxation policies?

A: Implementing effective EV taxation policies poses several challenges, including:

- Measuring and quantifying environmental impacts: Accurately assessing the carbon footprint of EV production, use, and disposal is complex.

- Ensuring fairness and equity: Balancing the need for revenue generation with the desire to encourage EV adoption is crucial.

- Managing public perception: Communicating the rationale behind EV taxation policies and addressing public concerns is essential.

Tips for Navigating the EV Taxation Landscape in 2025

- Stay Informed: Regularly monitor government announcements and industry updates regarding EV taxation policies.

- Consider Long-Term Costs: When purchasing an EV, factor in potential future taxation changes and compare them to the costs of gasoline-powered vehicles.

- Explore Incentives: Research available tax incentives or rebates for EV purchases in your region.

- Advocate for Sustainable Policies: Engage with government officials and industry stakeholders to promote fair and environmentally responsible EV taxation.

Conclusion

The landscape of EV taxation is evolving rapidly, driven by environmental concerns, fiscal sustainability, and market maturity. While blanket exemptions are fading, governments are adopting more equitable and sustainable approaches to ensure that EVs contribute to road maintenance and environmental costs. As the EV market continues to grow, the need for transparent, predictable, and adaptable taxation policies will become increasingly crucial. By embracing a comprehensive and collaborative approach, governments can foster a sustainable and equitable future for electric mobility.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Electric Vehicle Taxation in 2025. We hope you find this article informative and beneficial. See you in our next article!