The Evolving Landscape of Electric Vehicle Taxation: Navigating the Road Ahead

The Evolving Landscape of Electric Vehicle Taxation: Navigating the Road Ahead

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolving Landscape of Electric Vehicle Taxation: Navigating the Road Ahead. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolving Landscape of Electric Vehicle Taxation: Navigating the Road Ahead

The rapid adoption of electric vehicles (EVs) has spurred a global conversation about their role in shaping a sustainable future. This transition, however, necessitates a careful examination of the policy landscape, including the taxation of EVs. As the year 2025 approaches, various jurisdictions are grappling with the question of how to balance the need for environmental responsibility with the financial sustainability of their transportation systems.

Understanding the Shift: From Incentives to Revenue Generation

Historically, EVs have been incentivized to promote their adoption, with tax breaks and subsidies aimed at offsetting their higher purchase price. However, as EV penetration grows, the focus is shifting towards ensuring a fair and equitable contribution to public revenue. This shift is driven by several factors:

- Increasing EV Market Share: The widespread availability of EVs, coupled with declining battery costs and improving range, has led to a significant increase in their market share.

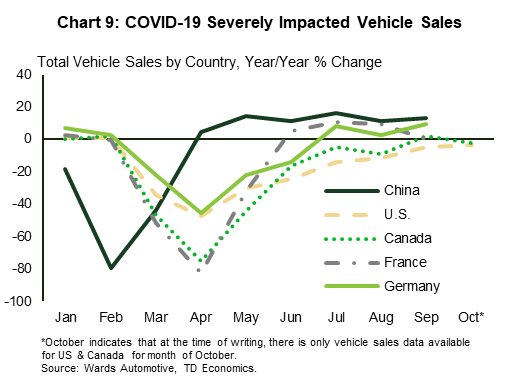

- Tax Revenue Shortfalls: Traditional fuel taxes, a primary source of revenue for road maintenance and infrastructure, are facing a decline as more drivers choose EVs. This creates a budgetary challenge for governments.

- Environmental Considerations: While EVs offer a cleaner alternative to gasoline-powered vehicles, they still generate wear and tear on roads and require infrastructure investments.

The 2025 Electric Vehicle Tax: A Global Perspective

The year 2025 marks a crucial juncture in EV taxation, with several countries and regions implementing or contemplating changes to their tax policies. These policies vary significantly in their scope and approach, reflecting the diverse economic and environmental contexts:

- Europe: The European Union (EU) is exploring a variety of options, including a "polluter pays" principle where EVs would contribute to road maintenance based on their usage. This approach aims to ensure fairness and avoid disadvantaging EV owners compared to traditional car owners.

- United States: The United States has seen a mix of policies, with some states extending tax incentives for EV purchases while others are considering road usage fees based on mileage. The federal government is also examining potential changes to its tax code to address revenue concerns.

- China: China, a global leader in EV manufacturing and adoption, is implementing a gradual shift towards a more nuanced tax structure. While initial incentives remain in place, the government is exploring options to ensure a long-term sustainable funding model for its transportation infrastructure.

Key Considerations in Designing EV Tax Policies

The design and implementation of EV tax policies require careful consideration of various factors:

- Fairness and Equity: Policies should be structured to ensure that EV owners contribute fairly to the costs of road infrastructure and maintenance, while avoiding undue burdens compared to traditional vehicle owners.

- Environmental Sustainability: Tax policies should incentivize the continued adoption of EVs and support the transition to a cleaner transportation system.

- Economic Impact: Policy changes should be implemented in a way that minimizes negative impacts on the EV industry, such as discouraging investment and innovation.

- Transparency and Predictability: Clear and predictable tax policies are crucial for consumer confidence and investment decisions.

FAQs on Electric Vehicle Taxation in 2025

Q: Will EV owners have to pay more taxes in 2025?

A: The answer depends on the specific jurisdiction. Some regions may introduce new taxes or adjust existing ones, while others may maintain existing incentives or introduce new ones. It is crucial to stay informed about the policies in your specific location.

Q: How will these taxes be calculated?

A: Different approaches are being considered, including mileage-based fees, vehicle weight-based taxes, or a combination of factors. The specific calculation method will vary depending on the policy adopted by each jurisdiction.

Q: What are the benefits of EV taxation?

A: EV taxation can help ensure fairness and sustainability in the transportation sector by:

- Generating Revenue: Providing a source of funding for road maintenance, infrastructure development, and other transportation-related initiatives.

- Promoting Equity: Ensuring that all vehicle owners contribute to the costs of using public roads.

- Encouraging Innovation: Driving research and development in the EV sector to enhance efficiency and reduce environmental impact.

Q: What are the potential drawbacks of EV taxation?

A: Potential drawbacks include:

- Discouraging EV Adoption: Higher taxes could discourage individuals from purchasing EVs, hindering the transition to a cleaner transportation system.

- Unintended Consequences: Complex tax structures could lead to unintended consequences, such as increased administrative burden or market distortions.

- Impact on the EV Industry: Rapid changes in tax policies could create uncertainty for the EV industry, potentially slowing down investment and innovation.

Tips for EV Owners and Consumers

- Stay Informed: Keep abreast of changes in EV tax policies in your region. Consult official government websites and automotive industry publications for the latest information.

- Consider the Long-Term Costs: Factor in potential future taxes when making EV purchasing decisions.

- Advocate for Fair and Transparent Policies: Engage in discussions with policymakers to ensure that EV tax policies are equitable, sustainable, and promote the transition to a clean transportation future.

Conclusion

The year 2025 marks a pivotal moment in the evolution of electric vehicle taxation. As EV adoption accelerates, governments are grappling with the need to balance revenue generation with environmental sustainability and the promotion of innovation. The successful implementation of EV tax policies will require careful consideration of fairness, equity, and the long-term implications for the transportation sector. By fostering open dialogue and engaging in constructive policy discussions, we can navigate the road ahead towards a cleaner, more sustainable future for transportation.

![]()

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Electric Vehicle Taxation: Navigating the Road Ahead. We hope you find this article informative and beneficial. See you in our next article!