The Shifting Landscape of Electric Vehicle Taxation: An Examination of Policies Post-2025

The Shifting Landscape of Electric Vehicle Taxation: An Examination of Policies Post-2025

Introduction

With great pleasure, we will explore the intriguing topic related to The Shifting Landscape of Electric Vehicle Taxation: An Examination of Policies Post-2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Shifting Landscape of Electric Vehicle Taxation: An Examination of Policies Post-2025

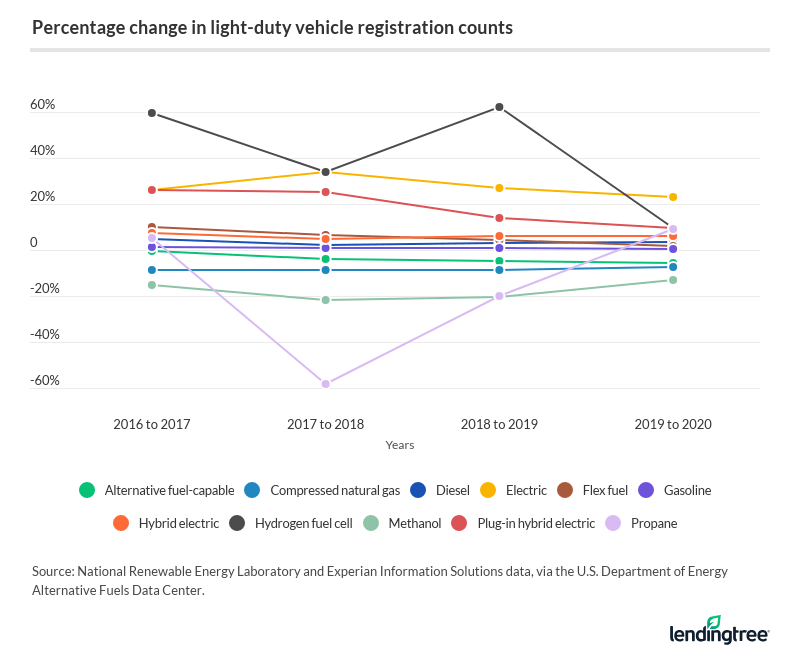

The transition to electric vehicles (EVs) is a critical step in mitigating climate change and achieving a sustainable future. However, the implementation of this transition necessitates a nuanced approach, particularly when it comes to taxation. As we approach 2025, the tax landscape surrounding EVs is undergoing a significant transformation, driven by evolving policy goals and a changing market dynamic.

The Rationale for Taxing EVs:

While EVs offer environmental advantages, they are not without their own complexities. The need for taxation arises from several factors:

- Revenue Generation: Governments need to maintain public services and infrastructure, including roads and charging stations. Taxing EVs, particularly those with higher purchase prices, can contribute to this revenue stream.

- Fairness and Equity: Traditional fuel-based vehicles are subject to fuel excise taxes, which contribute to road maintenance and infrastructure development. Introducing taxes on EVs ensures a more equitable system, where all vehicle owners contribute proportionally to these essential services.

- Encouraging Responsible Consumption: Taxing EVs could incentivize the purchase of more efficient and environmentally friendly models, promoting a shift towards sustainable transportation.

Taxation Strategies: A Global Perspective:

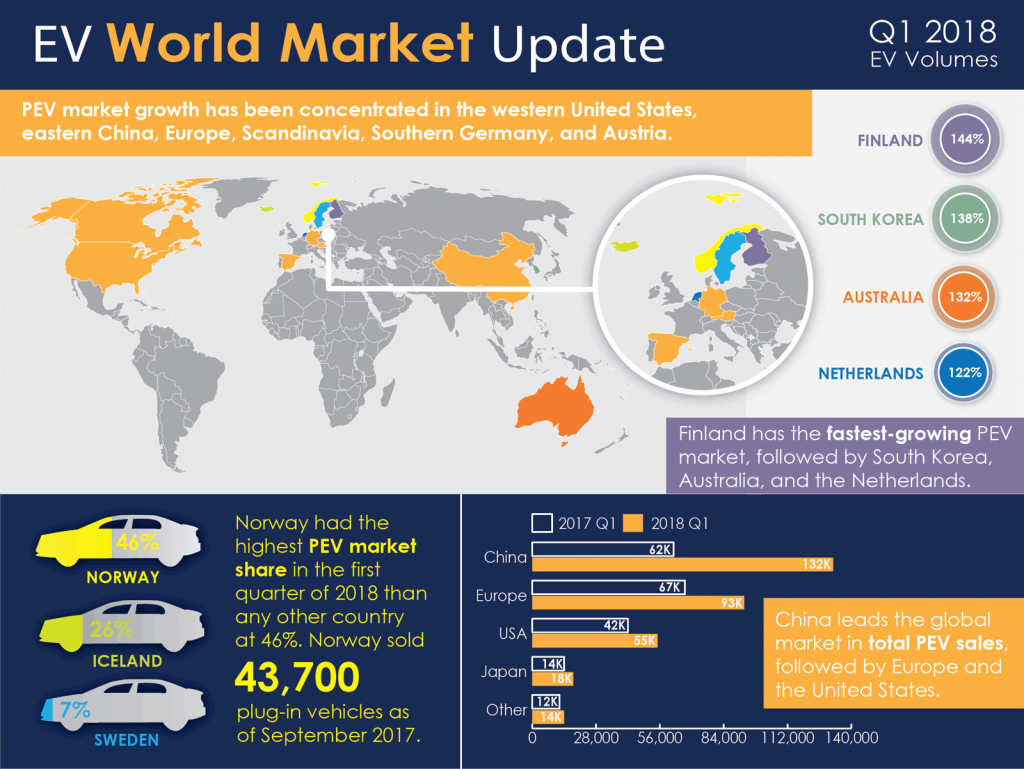

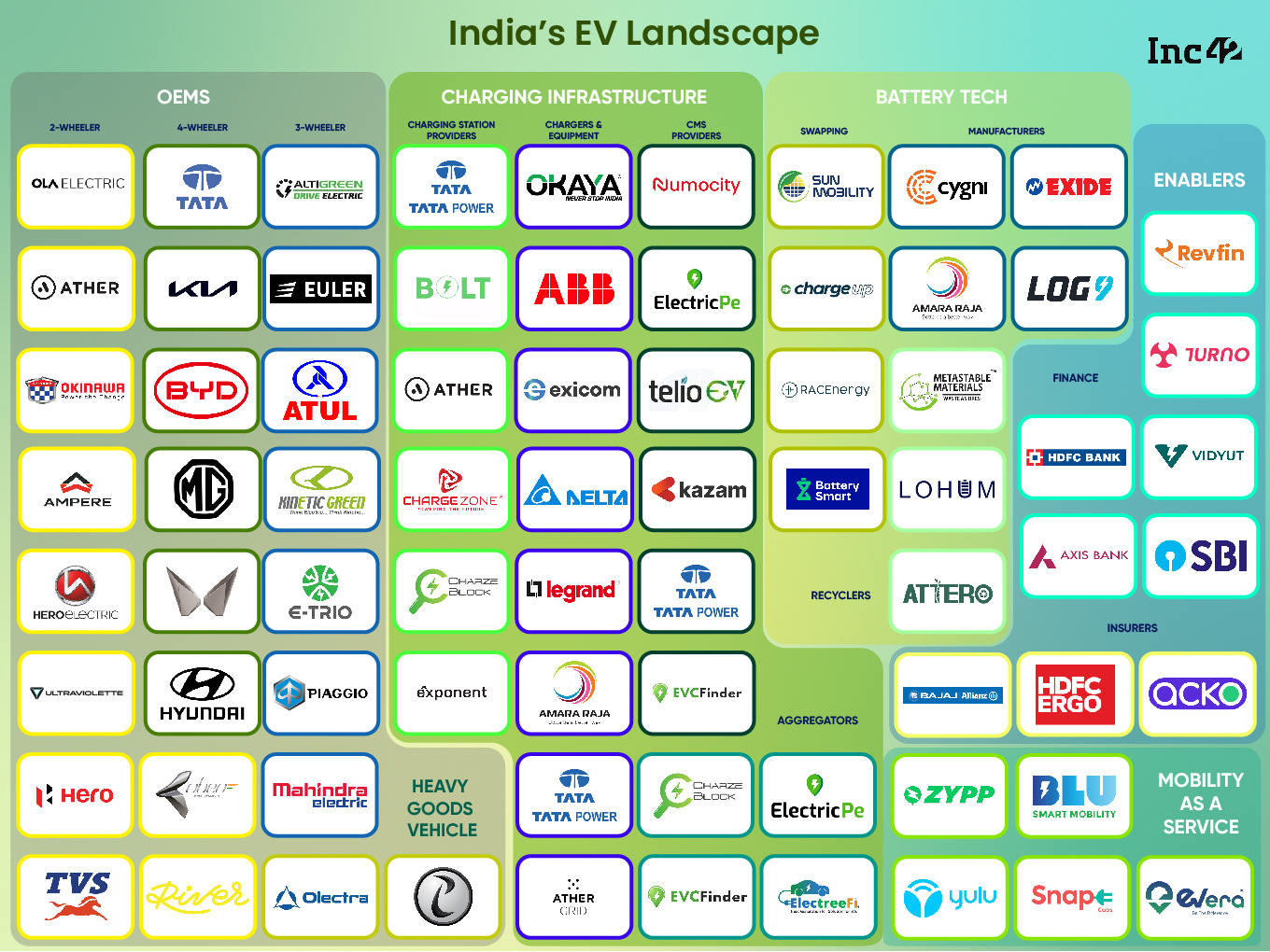

The taxation of EVs varies significantly across the globe, with governments adopting different approaches based on their priorities and economic circumstances. Some common strategies include:

- Sales Tax: Many countries apply standard sales tax on EVs, similar to the tax levied on traditional vehicles. This approach ensures a consistent revenue stream but may not incentivize EV adoption.

- Excise Tax: Some jurisdictions impose an excise tax on EVs, often based on factors like vehicle weight or battery capacity. This approach can generate additional revenue and potentially influence the purchase of less energy-intensive models.

- Road Tax: Several countries charge road taxes on EVs, either at a fixed rate or based on mileage. This system ensures that EVs contribute to road maintenance and infrastructure development, similar to fuel-based vehicles.

- Tax Incentives: While some countries are introducing taxes on EVs, others continue to offer tax incentives to encourage adoption. These incentives can take the form of tax credits, exemptions, or reduced registration fees.

The Future of EV Taxation: Navigating the Transition:

As EV adoption continues to rise, governments are facing the challenge of balancing revenue generation with the need to encourage sustainable transportation. The future of EV taxation will likely be characterized by:

- Dynamic Tax Structures: Tax rates on EVs may fluctuate over time, adapting to changing market conditions, technological advancements, and evolving policy goals.

- Focus on Environmental Performance: Future tax structures could incentivize the purchase of EVs with better fuel efficiency and lower emissions, promoting a shift towards cleaner transportation.

- Increased Transparency and Public Engagement: Governments are likely to increase transparency surrounding EV taxation, engaging with stakeholders to ensure a fair and equitable system that encourages responsible vehicle ownership.

FAQs on EV Taxation:

1. Will EVs be taxed more heavily than traditional vehicles?

The taxation of EVs is still evolving, and it is difficult to definitively state whether they will be taxed more heavily than traditional vehicles. In some jurisdictions, EVs may face higher taxes, while in others, they might be subject to lower or even zero taxation. The specific tax structure will depend on the policy goals and economic circumstances of each region.

2. What are the benefits of taxing EVs?

Taxing EVs can contribute to revenue generation, promote fairness and equity in the transportation sector, and encourage the purchase of more efficient and environmentally friendly models. These benefits can help governments fund essential services, ensure responsible vehicle ownership, and contribute to a sustainable future.

3. Will taxing EVs discourage their adoption?

While some argue that taxation could discourage EV adoption, it is important to consider the overall policy context. Governments may implement tax structures that balance revenue generation with incentives for EV adoption, creating a more favorable environment for consumers. Additionally, the benefits of owning an EV, such as lower running costs and reduced environmental impact, could outweigh any potential tax burdens.

4. How will the tax on EVs affect the cost of ownership?

The impact of taxation on the cost of EV ownership will vary depending on the specific tax structure implemented. In some cases, taxes may increase the overall cost of ownership, while in others, they may have a negligible impact. It is important to consider all costs associated with owning an EV, including purchase price, charging costs, and maintenance, when evaluating the financial implications of taxation.

5. What are the challenges of taxing EVs?

Implementing a fair and effective tax system for EVs presents several challenges. These include ensuring that the system is equitable and does not disproportionately impact low-income households, balancing revenue generation with the need to encourage EV adoption, and adapting the tax structure to technological advancements in the EV market.

Tips for EV Owners and Prospective Buyers:

- Stay Informed: Keep up-to-date with the latest developments in EV taxation and regulations in your region.

- Consider the Total Cost of Ownership: Factor in the cost of taxes, charging, and maintenance when evaluating the overall cost of owning an EV.

- Explore Incentives and Rebates: Research available government incentives and rebates for EV purchases and charging infrastructure.

- Support Sustainable Transportation Policies: Advocate for policies that promote EV adoption and sustainable transportation.

Conclusion:

The taxation of electric vehicles is a complex and evolving issue, with no single solution applicable to all jurisdictions. Governments are tasked with finding the right balance between revenue generation, promoting fairness and equity, and encouraging the adoption of sustainable transportation. As the EV market continues to grow, it is crucial for policymakers to implement transparent and effective tax structures that incentivize responsible vehicle ownership and contribute to a cleaner and more sustainable future.

Closure

Thus, we hope this article has provided valuable insights into The Shifting Landscape of Electric Vehicle Taxation: An Examination of Policies Post-2025. We hope you find this article informative and beneficial. See you in our next article!